Horden Lake

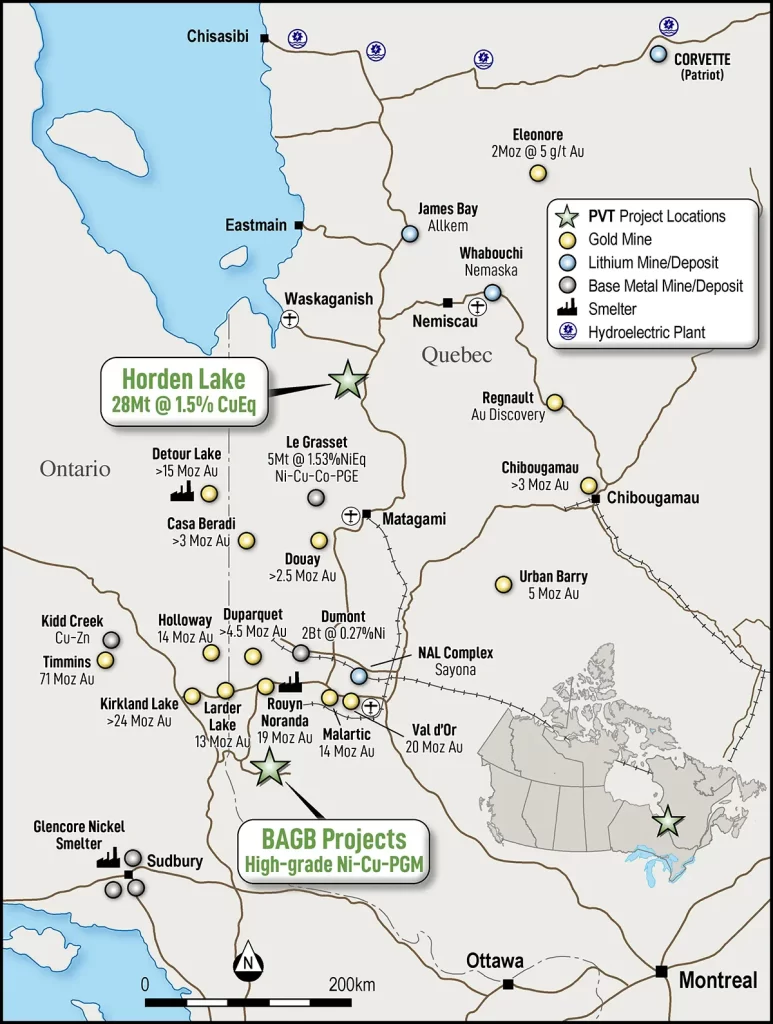

Pivotal owns 100% of the Horden Lake project; located 140km north of Matagami in northwest Quebec, sitting just 10km from the all-weather sealed James Bay Highway which leads to the second largest hydroelectric complex in the world, La Grande.

Horden Lake is copper dominant, but also rich in battery and precious metals meaning it has a favourable commodity mix for the transitional economy.

The Horden Lake project is defined by 52,000m of drilling, having been discovered by INCO in the 1960s before it benefited from the excellent road access it enjoys today.

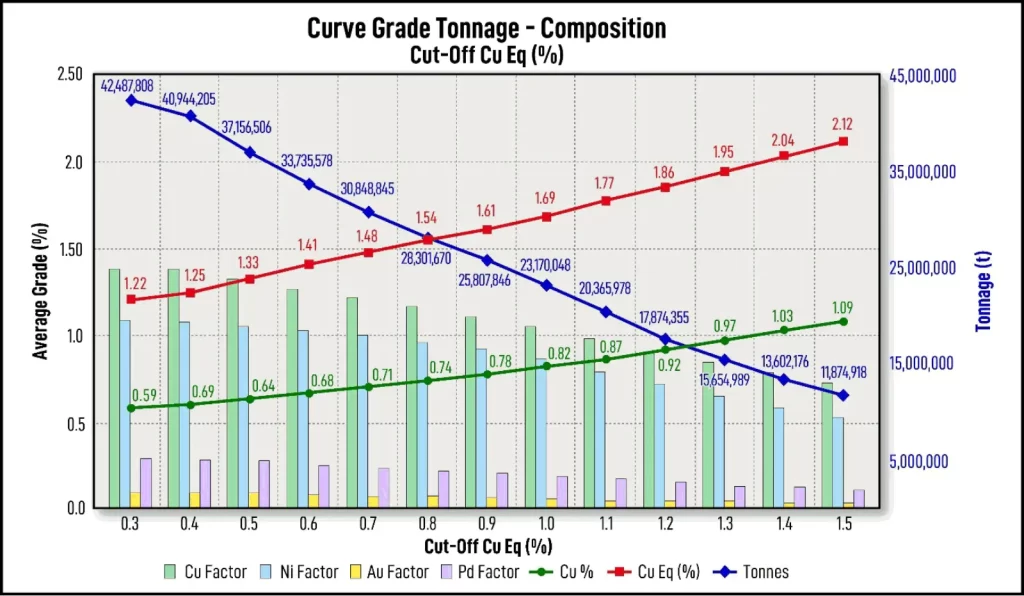

The project hosts a partially pit constrained JORC compliant mineral resource estimate of 27.8 Mt of 1.49% CuEq (0.3% CuEq Open Pit cut-off and 1.12% CuEq Underground cut-off applied), with 55% currently classified in the Indicated Resource category and 45% in the Inferred Category.*

* Cautionary statement: There is a lower level of geological confidence associated with Inferred mineral resources and there is no certainty that further exploration work will result in the determination of Indicated mineral resources.

CuEq = Cu% + (Ni.% x 2.59) + (Au.g/t x 0.63) + (Pd.g/t x 0.74)

The resource estimate currently contains just Cu, Ni, Au and Pd.

Category | Tonnes | Grade | Add New | Add New | Add New | Add New | Contained Metal | Add New | Add New | Add New | Add New |

Add New | Add New | CuEq (%) | CU (%) | Ni (%) | Au (g/t) | Pd (g/t) | CuEq (kt) | Cu (kt) | Ni (kt) | Au (koz) | Pd (koz) |

Indicated | 15.2 | 1.50 | 0.77 | 0.20 | 0.13 | 0.19 | 228.6 | 117.6 | 30.5 | 59.4 | 91.3 |

Inferred | 12.5 | 1.47 | 0.67 | 0.25 | 0.02 | 0.20 | 184.3 | 84.0 | 31.4 | 6.9 | 76.7 |

TOTAL | 27.8 | 1.49 | 0.74 | 0.22 | 0.08 | 0.19 | 413.9 | 201.6 | 61.9 | 66.2 | 168.0 |

Multi-element assays have only been taken over a portion of the deposit, and abundant Co, Ag and Pt exist but are not modelled. For example.

- HN-12-82: 7.7m averaging 2.75% Cu, 0.45 % Ni, 1.30 g/t Au, 0.47 g/t Pd, including also 500 ppm Co, 40.1 g/t Ag and 0.41 g/t Pt

- HN-12-84: 15.8m averaging 1.72% Cu, 0.35% Ni, 0.32 g/t Au, 0.33g/t Pd, including also 300 ppm Co 25.9 g/t Ag and 0.05 g/t Pt

- HN-12-88: 26.9m averaging 2.19% Cu, 0.58 % Ni, 0.27 g/t Au, 0.56 g/t Pd, including also 500 ppm Co, 30.5 g/t Ag and 0.16 g/t Pt

- HN-12-91: 12.3m averaging 1.10% Cu, 0.25% Ni, 0.15g/t Au, 0.19g/t Pd, including also 100 ppm Co, 16.4g/t Ag and 0.14g/t Pt

Furthermore, gold is constrained to only a portion of the deposit yet is diluted by 100% of the tonnes, meaning the effective grade under-stated.

These ‘byproducts’ are typically payable metals in copper and nickel concentrates and represent significant upside to the average grade of the deposit.

Pivotal’s exploration programs will strengthen Horden Lake by:

- Enhancing grade through inclusion of valuable byproducts

- Infill and expansion drilling to increase the size of the resource.

- Improved resource confidence

- Collection of metallurgical sample.

Preliminary metallurgical testwork demonstrate the potential for good recoveries across the payable metals in the Horden Lake deposit, further supporting the projections from a 1993 WGM report where historical test work produced copper concentrates grading 22-30% copper at recoveries ranging from 85-96%. It is the intention of the Company to conduct detailed metallurgical test work during 2024.

The Horden Lake deposit presents with a number of favourable characteristics that support the economic potential of the deposit.

- Pit constrained resources highlighting the potential for lower risk and capex starter open pit scenario

- Thick zones of mineralisation, in places over 30m thick, potentially suitable for lower cost higher tonnage open pit and underground mining methods

- Dip of between 45-55⁰ which is a favourable geometry for mining

- All season national highway access to within 10km of the deposit.

- Flat terrain with no mountain or river crossings

- Potential to connect to the Quebec grid, which is 99% renewable hydroelectricity – regularly among the lowest power costs in the world

- Northern Quebec is a mining state, with abundant mines, smelters, skilled labour, and all the services expected in a modern mining jurisdiction

Category | Tonnes | Grade | Add New | Add New | Add New | Add New | Contained Metal | Add New | Add New | Add New | Add New |

Add New | Add New | CuEq (%) | CU (%) | Ni (%) | Au (g/t) | Pd (g/t) | CuEq (kt) | Cu (kt) | Ni (kt) | Au (koz) | Pd (koz) |

Open Pit | 17.3 | 1.38 | 0.67 | 0.21 | 0.08 | 0.19 | 239.6 | 115.7 | 35.6 | 43.9 | 100.5 |

Underground | 10.5 | 1.66 | 0.82 | 0.25 | 0.01 | 0.13 | 173.9 | 85.9 | 26.3 | 22.3 | 67.5 |

TOTAL | 27.8 | 1.49 | 0.74 | 0.22 | 0.08 | 0.19 | 413.9 | 201.6 | 61.9 | 66.2 | 168.0 |